June 23, 2020 by Research Team

“I am fine today. Why should I buy health insurance? I haven’t visited a doctor till today.”

This is a basic question most young people have while considering buying a health insurance.

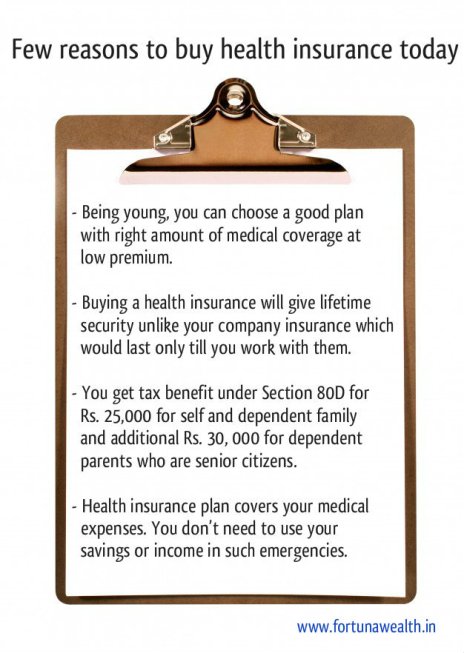

But you must realise that as you age your health changes. You might exercise regularly, follow a balanced diet and maintain a healthy lifestyle. But life is uncertain and you might have to bear an unexpected health expense.

A health insurance plan will help you cover medical expenses such as hospitalization costs, cost of medicines or doctor consultation fees which arise due to an illness.

The insurance company covers these expenses by:

Types of health insurance

Benefit policies are generally traditional health insurance policies. A pre-determined sum insured is paid in case of an accident or diagnosis of any of the illnesses, diseases, conditions, etc. which were insured in the plan. These policies provide the financial benefit as mentioned in the plan.

Indemnity policies cover the medical expenses incurred during hospitalization. You can claim expenses up to the limit mentioned in the policy by cashless claim or reimbursement. The most common type of indemnity policy is Health insurance plan.

Types of Health insurance:

Individual Health insurance covers only the individual insured.

Family Floater covers your entire family.

Critical Illness Health insurance covers specific life threatening diseases which could require prolonged treatment or even change in lifestyle. You can choose the critical illness cover as per your requirements. It can be used for any expenses such as hospitalization, medicine, lifestyle maintenance or you can simply use it as income till you work.

Group Health insurance is health insurance provided by the employer for its employees.

Overseas Health insurance covers healthcare expenses during your travel outside India.

Senior Citizen Health insurance is offered by few insurance companies specifically for senior citizens at competitive premium rates.

In times of unforeseen medical emergencies, health insurance plans provide security by covering healthcare expenses and thus reducing a lot of distress.

For more information please visit http://www.fortunawealth.in