Individual plan vs Family floater plan

June 23, 2020 by Research Team

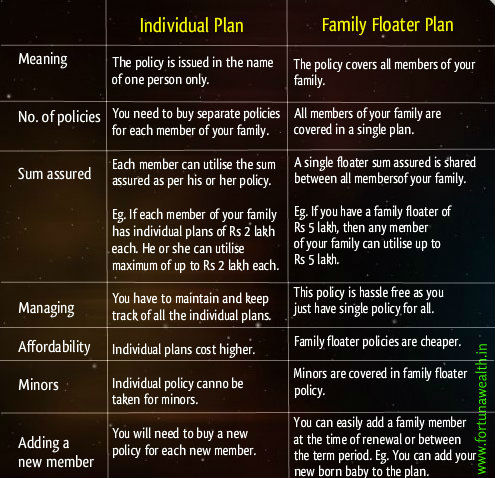

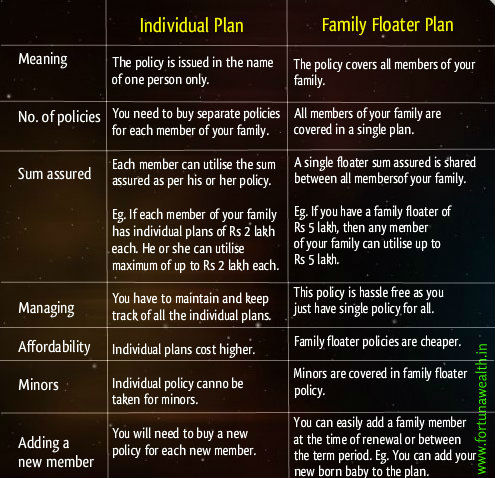

Deciding whether to buy an individual health plan or a family floater policy might be confusing for many.

To help you make a better and wise decision, here is a comparison of both these plans:

Few other points to consider in family floater plans:

- Premium is determined according to the senior most member in the plan.

- When a child reaches the maximum age (usually 25 years), he or she will need to buy a new policy. All the benefits of the old policy will be transferred to the new policy.

- No Claim Bonus (NCB) is not given in case of claim from even one member.

- In case of unfortunate death of the senior most member, the surviving members can continue the policy.

- Generally children and dependant parents are covered in a family floater plan. If you want a cover for grandparents or in-laws, you will need to buy an individual plan for them.

A common plan for all the members in the family could be expensive.

You can save on premium by buying a family floater for yourself and dependent kids; and a separate plan for senior parents.