June 23, 2020 by Research Team

While retirement may seem distant for many, retirement security is as important as any of your other financial goals.

Due to rising cost of living, inflation and increased life expectancy, financial planning is essential to live a happy and comfortable life after retirement.

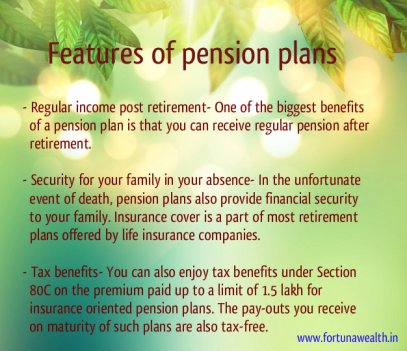

Pension plans or retirement plans are one of the tools available to build a retirement corpus.

Pension plan provides regular fixed monthly pension at the end of the period for lifetime. Investment is made by paying premiums to build a corpus which is invested in various funds.

Insurance companies, Mutual fund companies and Government provide pension plans with unique benefits.

For instance, Insurance companies provide pension plans with the waiver of premium rider or partner care rider.

In the event of an unforeseen calamity like death, the future premiums will be waived off.

The Insurance company will pay the future premiums on your behalf. This will ensure that your nominee receives the same pension till the end of the period.

Do consult your financial advisor to choose the appropriate plan as per your requirements.

Types of pension plans:

Immediate Annuity

In immediate annuity, the pension begins immediately. You have to pay a lump sum amount and your pension will start instantly.

The pension you receive will be based on the lump sum you have invested.

Deferred Annuity

In deferred annuity, pension does not commence immediately. It is ‘deferred’ up to a time, which is decided upon by you.

This implies that you have to pay the premiums till the policy term, after which you will start receiving your pension.

Premiums can be paid as single premium or as regular premium.

With cover pension plan

‘With cover’ plan provides life coverage which implies that in case of death, a lump sum amount is paid to your family.

However, the cover amount is not very high as major part of the premium is invested to build the retirement corpus.

Deferred annuity plans are available with cover.

Without cover pension plan

‘Without cover’ implies that you do not get any life cover.

In case of death, your family will receive the accumulated corpus till the date of your death.

Immediate annuity plans are available without cover.

Annuity Certain

The annuity is paid for a specific period as chosen by you.

In case of death before this period, your beneficiary would receive the annuity.

Guaranteed Period Annuity

Annuity is paid for certain periods whether or not you survive that duration.

Life Annuity

In a life annuity plan pension is paid until death.

If you choose ‘with spouse’ option, then in case of death, the pension is paid to your spouse.

National Pension Scheme (NPS)

NPS has been introduced by the government. The amount you save in NPS will be invested in equity and debt.

You have the option of withdrawing 60% of the amount at retirement and the remaining 40% has to be used to purchase annuity.

The maturity amount is not tax free though.