Mutual fund basics

June 23, 2020 by Research Team

What is a Mutual Fund (MF)?

A mutual fund is a trust that pools money of like-minded investors with similar investment objective.

These MF schemes are managed by respective Asset Management Companies (AMC).

The AMC hires a professional money manager, who buys and sells securities in line with the fund’s stated objective.

The pooled money is invested in a diversified portfolio of securities including equity shares, debentures, convertibles, bonds, money market instruments or other securities.

Each unit of any scheme represents the proportion of pool owned by the investor (unit holder).

How do I get returns on a MF?

Returns on a MF are earned in the form of:

- Dividends- Unit holders earn dividends on MFs, which are distributed from the income generated through dividends on stocks and interest on other instruments.

- Capital gains- If the fund sells securities that have appreciated in value, it earns capital gains. These capital gains are usually distributed to investors.

- Profit from higher NAV- Increase in value of fund’s asset increases the NAV of the fund. An investor can make profit by selling back their units to the fund house.

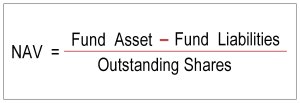

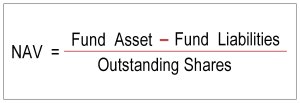

What is Net asset value (NAV)?

NAV is the appreciation or reduction in value of investments which is regularly declared by the fund.

NAV per unit is calculated as:

What are the benefits of MFs?

- Diversification- MF portfolio includes a wide variety of investments in order to mitigate risks.

- Flexibility- MFs offer a variety of plans such as regular investment, regular withdrawal and dividend reinvestment plans. Depending upon your preferences and convenience, you can invest or withdraw funds, accordingly.

- Liquidity- Investors can buy or sell an open-ended scheme from the fund house anytime. Close-ended schemes too can be sold on the stock exchange. Few close-ended and interval schemes allow direct repurchase of units from time to time.

- Cost Effective- MFs are less expensive as compared to direct investment in the capital markets.

- Professional Management- MFs are managed by experienced and skilled professionals who research and analyse the performance and prospects of various instruments before selecting a particular investment.

- Transparency- MF fact sheets, offer documents, annual reports and promotional materials provide high degree of transparency.

- Return Potential- Depending on the investment portfolio, the MFs offer a chance of higher potential of returns.

- Choice of Schemes- There are wide variety of MF schemes available to suit each investor.

- Well Regulated- MFs in India are regulated and monitored by the Securities and Exchange Board of India (SEBI), which strives to protect the interests of investors.